Expert traders have honed their craft over years of market observation, trial, and error. Their success lies in a disciplined approach and an adherence to key trading principles. In this comprehensive guide, we will explore essential trading rules that form the backbone of expert pro traders’ strategies. Whether you’re a beginner or looking to refine your approach, these strategies can help enhance your trading skills.

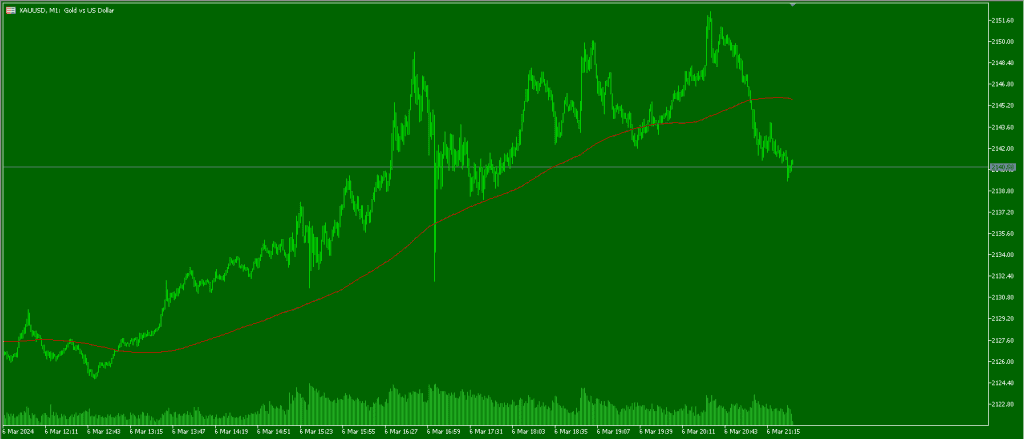

1. Follow the Trend

One of the cardinal rules in trading is to trade in the direction of the trend. As the saying goes, “Trend is your friend until it bends.”

- Why It Matters:

Following the trend helps in maximizing profitability. When the market is trending, aligning your trades with the prevailing direction minimizes risk and increases the probability of success. - How to Implement:

- Use higher timeframes (HTF) to determine the primary trend.

- Confirm the trend direction before entering trades on lower timeframes (LTF).

By identifying and following the trend, traders set the stage for more confident decision-making.

2. Candlestick Confirmation & Formation Analysis

Expert traders do not solely rely on one type of analysis. They incorporate both candlestick confirmation and formation analysis to gain deeper market insights.

- Candlestick Confirmation:

This involves waiting for certain candlestick patterns to complete, confirming the trend direction before placing a trade. - Formation Analysis:

By studying the formation of the candlestick patterns, traders can identify early signals of market reversals or continuations.

Utilizing both methods provides a more robust framework for identifying profitable trading opportunities.

3. Support & Resistance + Supply & Demand

Before entering any trade, expert traders carefully assess support and resistance levels alongside supply and demand zones, particularly on D1/H4 charts.

- Support & Resistance:

These levels help determine where the price may reverse or continue its trend. - Supply & Demand Zones:

Recognizing these areas provides insight into where buyers and sellers are likely to enter or exit the market.

Key Steps:

- Identify Key Levels:

Analyze higher timeframes to pinpoint major support and resistance levels. - Cross-Reference Zones:

Check for alignment with supply and demand areas to validate potential trades. - Confirm with Indicators:

Use additional technical indicators for extra validation.

This dual approach allows traders to make more informed decisions, reducing the likelihood of entering a losing trade.

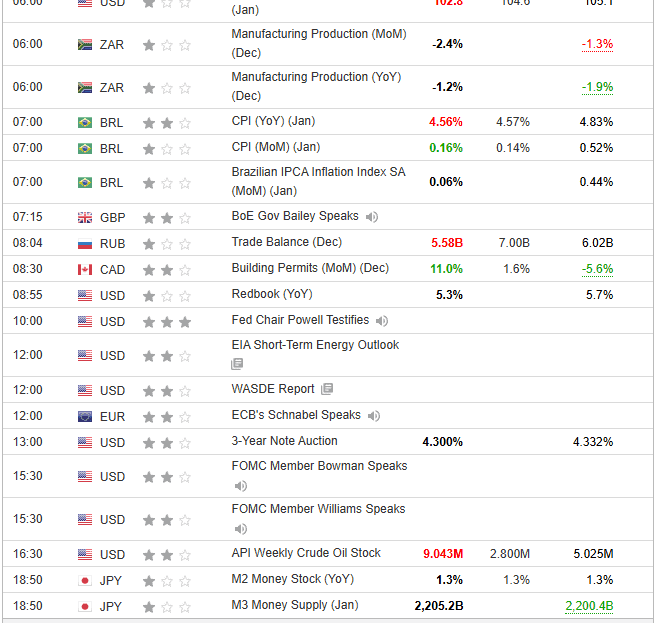

4. Fundamental Analysis

Expert traders do not rely solely on technical analysis. They incorporate fundamental analysis by blending economic and geopolitical news with technical signals.

- Economic News:

Understanding macroeconomic trends can offer context to market movements. - Geopolitical Events:

Political events and global news often influence market sentiment and volatility.

By combining both technical and fundamental analysis, traders gain a holistic view of the market.

5. Market Sentiment

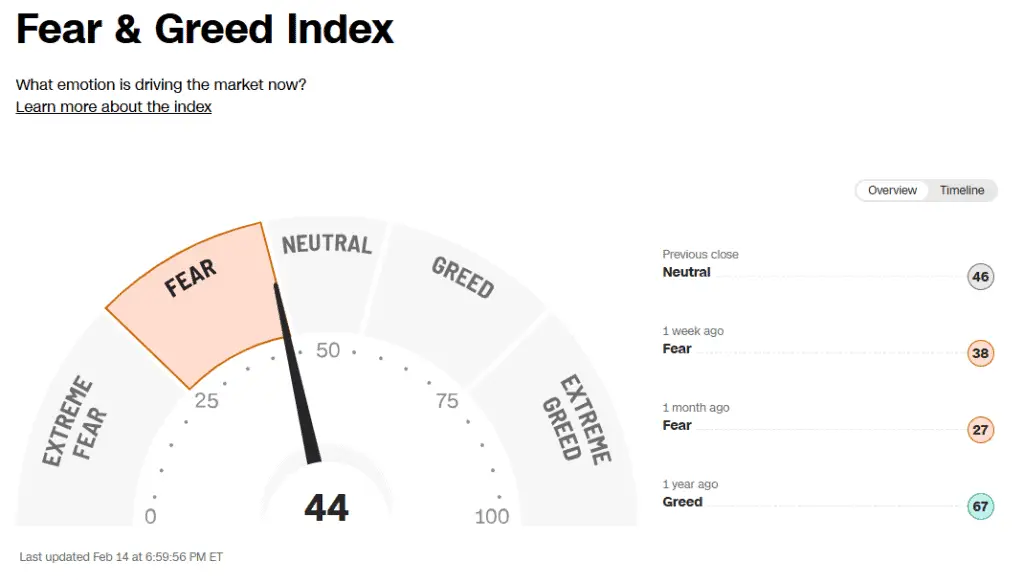

Accurately gauging market sentiment is essential for timely entry and exit points. Pro traders use various tools to assess whether the market is bullish or bearish.

- Popular Tools Include:

- Fear & Greed Index: Measures market sentiment by evaluating the level of fear or greed among investors.

- COT Report: Provides insight into the positions of major market participants.

- VIX Index: Known as the “fear gauge,” it measures market volatility.

Understanding market sentiment helps traders position themselves correctly, whether entering long or short positions.

6. Setting Stop Loss & Take Profit Properly

Managing risk is paramount in trading. Expert traders set stop loss and take profit levels strategically.

- Stop Loss:

This level is set to automatically close a position if the market moves unfavorably, limiting potential losses. - Take Profit:

This level ensures that profits are secured once the market reaches a predetermined point.

Best Practices:

- Assess Risk-to-Reward Ratio:

Aim for a ratio of 1:2 or 1:3 to ensure that the potential gain outweighs the risk. - Use Technical Levels:

Position your stop loss and take profit around key support/resistance or pivot points.

This strategic placement helps protect capital and ensures that profits are captured at optimal moments.

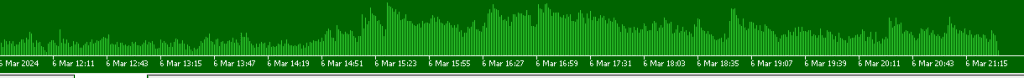

7. Volume Analysis

Volume is a critical indicator of market activity. Volume analysis involves monitoring sudden spikes which often signal significant market moves.

- Importance of Volume:

An increase in volume can confirm the strength of a trend or indicate potential reversals. - How to Monitor:

Use trading software that displays real-time volume data alongside price movements.

By understanding volume trends, traders can better gauge the sustainability of a price move.

8. Right Entry Level Identification

Determining the correct entry level is crucial for a successful trade. Pro traders analyze various factors to pinpoint the optimal moment to enter the market.

- Factors Considered:

- HTF to LTF Trends: Aligning trends across multiple timeframes.

- Supply & Demand Zones: Identifying areas where price is likely to react.

- Order Blocks and Liquidity: Recognizing areas of accumulated orders.

- Support & Resistance Levels: Using these as confirmation for entry points.

This multifaceted approach helps in reducing entry errors and enhancing overall trade success.

9. Matching Small & Large Timeframes

Expert traders often use a multi-timeframe approach. They first identify the primary trend on higher timeframes (HTF) and then look for trade setups on lower timeframes (LTF).

- Steps to Follow:

- Identify the Trend on HTF:

Establish the overall market direction. - Confirm on LTF:

Look for entry signals that align with the HTF trend.

- Identify the Trend on HTF:

This method provides a more accurate and refined entry, reducing the risk of misinterpreting short-term fluctuations.

10. Trading Psychology

Beyond technical skills, successful trading heavily depends on trading psychology. Maintaining emotional control is vital.

- Key Psychological Factors:

- Emotional Discipline:

Avoid making impulsive decisions based on fear or greed. - Rational Decision-Making:

Stick to your trading plan and strategies. - Stress Management:

Learn to handle market volatility without losing focus.

- Emotional Discipline:

By prioritizing mental discipline, traders can make clearer, more informed decisions.

11. Perfect Segment Identification

Expert traders identify market segments that offer high-probability setups. They focus on specific segments rather than trying to trade every market movement.

- How to Identify Segments:

- Analyze Historical Data:

Look for recurring patterns or trends. - Use Technical Indicators:

Employ indicators to identify segments with favorable conditions.

- Analyze Historical Data:

This focus enables traders to concentrate on areas where they have a competitive edge.

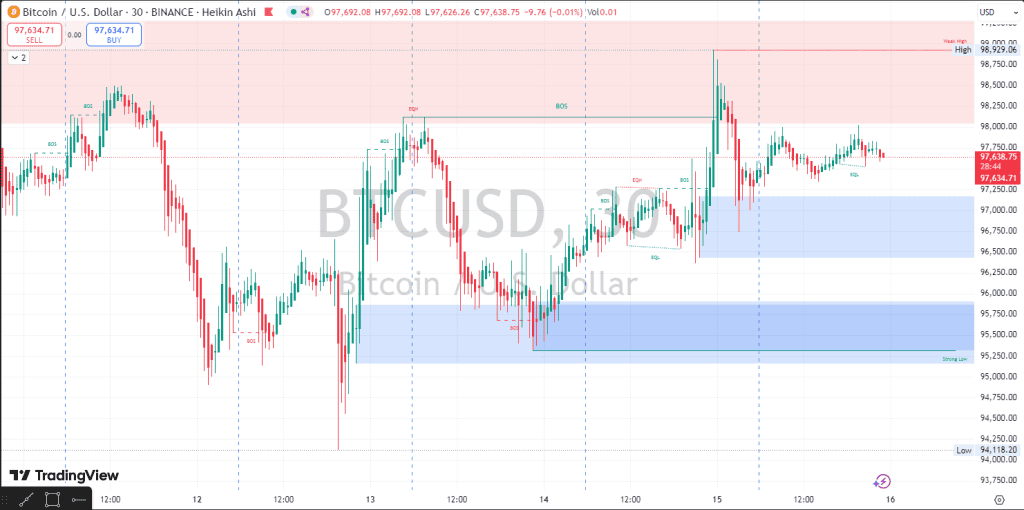

12. Using Pivot Points & Fibonacci

Technical tools like pivot points and Fibonacci retracement are vital for identifying potential support and resistance areas.

- Pivot Points:

These are calculated levels that indicate possible turning points in the market. - Fibonacci Retracement:

This tool helps identify areas where the price might reverse following a significant move.

Both tools are particularly useful after major changes in market structure such as CHOCH (Change of Character) or BOS (Break of Structure).

13. Risk-to-Reward Ratio

A disciplined approach to risk management involves maintaining an appropriate risk-to-reward ratio.

- Typical Ratios:

Many expert traders aim for a 1:2 or 1:3 ratio, ensuring that potential profits are significantly higher than the risks taken. - Implementation Tips:

- Calculate Potential Gains vs. Losses:

Before entering a trade, determine if the risk-to-reward ratio meets your criteria. - Stick to Your Plan:

Avoid making adjustments mid-trade that could disrupt this balance.

- Calculate Potential Gains vs. Losses:

This strategy is fundamental in ensuring long-term profitability.

14. Checking Higher Timeframe Conflicts

Ensuring that trends on various timeframes are in alignment is crucial. Expert traders avoid conflicts between different timeframes.

- Example Scenario:

If the H4 timeframe is bullish but the Daily chart shows a downtrend, traders typically avoid taking a long position. - How to Avoid Conflicts:

- Cross-Check Trends:

Analyze multiple timeframes before making a decision. - Wait for Convergence:

Only take trades when the trend is clear across all relevant timeframes.

- Cross-Check Trends:

This approach minimizes the risk of entering trades based on conflicting signals.

15. Divergence Confirmation

Identifying divergence between price action and technical indicators is a powerful tool.

- Types of Divergence:

- Hidden Bullish Divergence:

Indicates a potential long entry when paired with a trendline break. - Regular Divergence:

Can signal a weakening trend or a possible reversal.

- Hidden Bullish Divergence:

- Confirmation Strategy:

- Combine divergence signals with other indicators such as support/resistance or volume analysis to confirm the trade setup.

This method helps in identifying potential market reversals with greater accuracy.

16. Breakout/Breakdown Confirmation

A breakout or breakdown can be a clear signal for a trade entry. Pro traders confirm these moves by waiting for a candlestick to close 3% outside key support or resistance levels.

- Key Points:

- Wait for the Close:

Ensure the breakout or breakdown is valid by waiting for a full candlestick close. - Validate with Volume:

Higher volume during a breakout can confirm the strength of the move.

- Wait for the Close:

This disciplined approach prevents false breakouts from triggering premature entries.

17. Multi-Timeframe Convergence

When signals converge across multiple timeframes, the strength of the trade setup increases significantly.

- Example Setup:

A daily or H4 uptrend combined with a bullish setup on H1 or M30 provides a strong signal for a long entry. - How to Apply:

- Verify Across Timeframes:

Use a top-down analysis to ensure that all relevant timeframes align. - Monitor for Consistency:

Look for consistent signals before committing to a trade.

- Verify Across Timeframes:

Multi-timeframe convergence enhances the reliability of your trading decisions.

18. Liquidity Zone & Session Liquidity Check

Understanding where liquidity is concentrated can greatly influence your trading strategy.

- Liquidity Zones:

Identify areas with high liquidity as they often signal potential support and resistance levels. - Session Liquidity:

Check liquidity levels during different trading sessions to avoid low-volume periods which can lead to slippage.

By analyzing liquidity zones, traders can better time their entries and exits.

19. Selecting the Right Trading Time

Timing is everything in trading. Expert traders carefully choose the best times to enter and exit trades.

- Considerations for Timing:

- Market Open and Close:

These periods often present increased volatility and liquidity. - Economic Calendars:

Be aware of scheduled economic releases that could impact market conditions. - Session Overlaps:

Trading during the overlap of major market sessions (e.g., London-New York) can provide enhanced opportunities.

- Market Open and Close:

Choosing the right time to trade maximizes potential returns while minimizing risk.

20. Diversification

Spreading your trades across different assets and markets is a key strategy to minimize risk.

- Benefits of Diversification:

- Risk Management:

Reduces the impact of a single asset’s adverse movement. - Opportunities:

Provides exposure to multiple markets and trading setups.

- Risk Management:

- How to Diversify:

- Asset Classes:

Consider trading in forex, commodities, stocks, or cryptocurrencies. - Strategies:

Use different trading strategies to ensure your portfolio is balanced.

- Asset Classes:

Diversification helps in smoothing out overall returns and managing risk effectively.

21. Long-Term Vision

While short-term gains can be enticing, expert traders focus on sustained profitability over the long term.

- Key Elements:

- Consistent Profitability:

Develop strategies that yield consistent results over time. - Avoiding Overtrading:

Focus on quality trades rather than the quantity of trades. - Continuous Learning:

Regularly review and refine your strategies based on market conditions.

- Consistent Profitability:

Maintaining a long-term perspective ensures that your trading approach remains resilient in changing market environments.

22. Using Reliable & Tested Tools

In the modern trading landscape, having access to reliable tools is non-negotiable.

- Essential Tools:

- Trading Software:

Utilize platforms like MT5 which offer advanced charting and analysis. - Indicators & Calculators:

Employ proven technical indicators and risk management calculators. - Automated Strategies:

Consider automating parts of your strategy to reduce manual errors and increase efficiency.

- Trading Software:

Relying on tested tools can significantly enhance your trading performance.

23. Patience & Caution

Rushing into trades can be a costly mistake. Expert traders wait for the right setup and exercise patience.

- Why Patience Matters:

- Avoiding Impulsive Decisions:

Waiting for the right moment helps in avoiding decisions driven by emotion. - Increased Accuracy:

A well-timed trade is far more likely to succeed than a rushed one.

- Avoiding Impulsive Decisions:

Caution is key to long-term trading success, allowing you to wait for optimal opportunities rather than chasing every market movement.

24. Learning from Mistakes

Finally, one of the most valuable lessons is to learn from your past mistakes.

- Reflection:

After each trade, review what went right and what could be improved. - Documentation:

Keep a trading journal to record insights and patterns over time. - Adaptation:

Adjust your strategy based on what you have learned from both successful and unsuccessful trades.

This continuous learning process is what transforms a good trader into a great one.

Final Words

Forex and proprietary firm trading are challenging endeavors that require a blend of technical expertise, disciplined strategy, and emotional control. By following these secret tips and key trading rules, you can build a robust foundation for improving your trading skills. Remember, trading is not about quick wins—it’s about consistent, well-informed decisions over time.

Are you ready to take your trading strategy to the next level? If you’re interested in automating any of these strategies in MT5, click here to get started and let us help you streamline your approach!